The Great Resignation: Up In Smoke

Sep 26, 2022Background: The Great Resignation

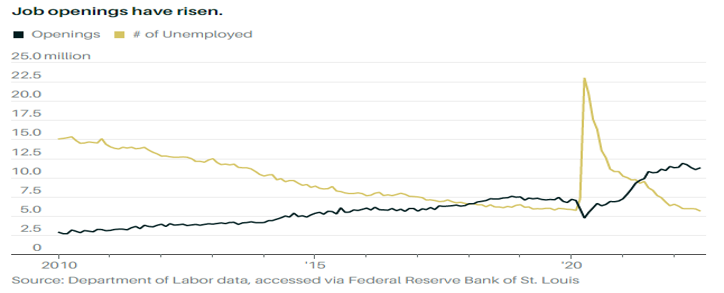

Despite considerable progress in the standard of living for the average working American, labor challenges continue with millions of workers — harboring discontentment with stagnant wages and re-examining work-life balance during the COVID-19 pandemic — deciding to quit their jobs en masse in what has been dubbed the ‘Great Resignation.’ However, a resurgent U.S. economy drastically increased demand for workers (especially in the service industry), ultimately leading to the low unemployment rates (3.7%) we see today.1 So, with unemployment at relatively low levels, Americans might ask why their favorite restaurants are closed on a weekday, or why they are waiting 10-20 minutes at a drive-thru. Well, economists have a plethora of answers, but one theory yet to be discussed in the press (which will be elaborated on below) is the rise of the cannabis industry. As shown in the chart below, data released by the Bureau of Labor Statistics (BLS) indicate there are 11.2 million job openings in the U.S. as of July 31.2 While down slightly from peak levels seen in April, the number remains quite elevated historically. If you compare that to the 6.01 million currently unemployed as of August 31 there are nearly two jobs open for every unemployed person in the country.1

What’s driving this disconnect you ask? The initial consensus was government stimulus. Recently though, COVID and declining immigration figures have shouldered the blame. To further elaborate on those points, researchers from the St. Louis Fed estimate there were more than two million “excess” retirements during the pandemic, as more Americans have stayed home for a multitude of reasons, including the effects of long COVID.3 A study done by the National Bureau of Economic Research estimated that between long-term health effects, fear of the virus, and the illness itself, COVID is responsible for a decrease of 1.5 million workers in the labor force. Furthering the long COVID concept, the same study also reported that employees who suffered week-long absences from the virus are 7% less likely to be in the labor force one year later.4 Another explanation is offered by Giovanni Peri, professor of economics at U.C. Davis, and Reem Zaiour, a doctoral economics student at U.C. Davis, who found that by the end of 2021 there were roughly two million fewer working-age immigrants in the U.S. than there would have been had pre-pandemic trends continued. It is also worth noting that half of this collective would have been in highly educated science, technology, engineering, and math (also known as STEM collectively), fields.5

While these are the most common themes behind the employment data, there are other theories and hypotheses economists point to in their data dissemination. However, we believe there is another bucket responsible for a lack of available workers that deserves further investigation.

Up In Smoke: The Rise of the American Cannabis Industry 6

Since 2012, 19 states (21 if you include the District of Columbia and Guam) have passed legislation legalizing recreational marijuana use. According to 2020 U.S. Census Bureau numbers, more than 146 million Americans now live in a state that has legalized marijuana.7 We expect the number of states adopting legalization to continue to increase going forward, as about two-thirds of American adults support marijuana legalization at both the federal and state level, according to an April 2022 survey by CBS News/YouGov.8 Despite the rise in legalization as well as popularity, Federal prohibition prevents the U.S. Department of Labor’s BLS from counting state-legal marijuana jobs in their monthly nonfarm payroll data.

Enter the Leafly Jobs Report, produced annually in partnership with Whitney Economics. While not published as frequently as the BLS jobs report, the Leafly Jobs Report includes both direct plant-touching jobs and indirect jobs that support the industry or otherwise depend on the state-legal status of cannabis. The Report does not, however, include hemp or unregulated products made with hemp-derived cannabinoids like delta-8 THC.

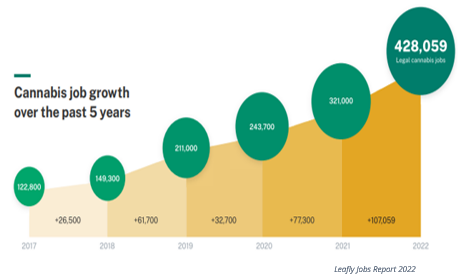

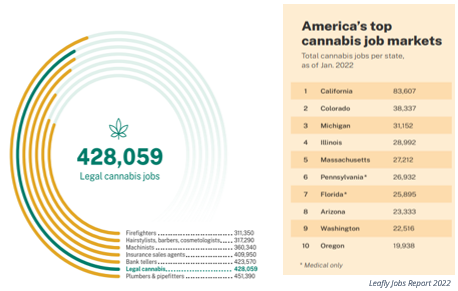

According to their most recent publication, as depicted above, in the second year of the COVID-19 pandemic, America’s 11 operating adult-use markets and twenty-seven medical-only states combined to sell $24.6 billion worth of cannabis products in 2021 (more than energy drinks, milk, and orange juice) and created more than 107,000 new jobs. That is a 33% increase in jobs in a single year, which represents the fifth consecutive year of annual job growth exceeding 27%. No other industry in America can match that. To put those figures in perspective, America’s entire financial sector added 145,000 jobs last year. The construction industry, coast to coast, added 165,000 jobs. Furthermore, America now has three times as many cannabis workers as dentists. Cannabis workers also outnumber insurance salespeople. And there are more people employed in the cannabis industry than there are hair stylists, barbers, and cosmetologists—combined. Last year, America’s legal cannabis industry created more than 280 new jobs every day. In 2021, someone was hired for a cannabis-supported job about every 2 minutes of the workday. California remains America’s #1 cannabis market and cannabis employer, while states like Massachusetts, Illinois, Michigan and Arizona continue to add jobs at a double-digit clip.

While impressive, it is important to note that 75% of the nation’s true cannabis demand is still being met by illicit growers and sellers. Those numbers include illicit sales in all legal, medical, and prohibition states. With New Mexico, New Jersey, New York, and Connecticut expected to open their first adult-use cannabis stores within the next 18 months, America’s cannabis job creation boom is expected to continue through at least 2025 based on Whitney’s estimates. So, while economists stay laser-focused on the BLS data, we believe a complete review of the employment situation should include data on the cannabis industry as well.

With seemingly favorable business trends it would seem logical to ask, are we investing in cannabis stocks? In short, no. We have held the same stance on marijuana stocks since they were first listed, even as most cannabis ETFs have come down off their pandemic-fueled highs and are trading at a 50% to 70% discount. This in large part is due to the overwhelming advantage that well-established tobacco companies hold. The best illustration of this dominance would be revenue, as the domestic tobacco market brought in nearly $76 billion in 2021 (or three times that of cannabis), a figure that is dwarfed by over $849 billion in global tobacco revenue.9 Since the tobacco industry has deep pockets, large production capabilities, and established supply lines, we predict that cigarette manufacturers will ultimately dominate the cannabis industry through buyouts and/or internal shifts. While there is undeniably money to be made in cannabis, we believe that the opportunities presented (even as valuations have fallen precipitously) aren’t worth the excessive risk, especially as tobacco manufacturers have the inside track.

Managed Asset Portfolios Investment Team

Michael Dzialo, Karen Culver, Peter Swan, John Dalton, and Zachary Fellows

September 2022

1https://www.bls.gov/news.release/empsit.nr0.htm

2https://www.bls.gov/news.release/jolts.nr0.htm

3https://research.stlouisfed.org/publications/economic-synopses/2021/10/15/the-covid-retirement-boom

4https://www.nber.org/papers/w30435

6https://leafly-cms-production.imgix.net/wp-content/uploads/2022/02/22132544/LeaflyJobsReport2022.pdf

7https://www.census.gov/data/tables/2020/dec/2020-apportionment-data.html

8https://www.cbsnews.com/news/marijuana-recreational-legalize-opinion-poll-2022-04-20/

Certain statements made by us may be forward-looking statements and projections which describe our strategies, goals, outlook, expectations, or projections. These statements are only predictions and involve known and unknown risks, uncertainties, and other factors that may cause actual results to differ materially from those expressed or implied by such forward-looking statements. The information contained herein does not represent a recommendation by us to buy or sell any security or securities. Managed Asset Portfolios, our clients and our employees may buy, sell, or hold any or all of the securities mentioned. We are not obligated to provide an update if any of the figures or views presented change. Past Performance is no guarantee of future results.