MAP Views Third Quarter 2022

Jul 12, 2022Stock markets wrapped up the first half of 2022 on a sour note. Investors braced for higher interest rates as the Federal Reserve (the Fed) attempted to combat the highest inflation levels in approximately 40 years. All three major U.S. indexes posted their second straight quarter of declines. U.S. stocks posted their worst first half in over 52 years as valuation levels contracted from near-record high levels. The S&P 500 printed its worst half-year since 1970, the Dow had its most significant first-half drop since 1962, and the NASDAQ's largest percentage drop ever. Not surprisingly, stocks with the loftiest valuations generally performed the worst, while those with more modest valuations lost ground but were generally spared from the worst of the declines. Globally, the picture was not much different, as most countries face similar inflationary pressures.

During the first quarter of 2022, MAP's portfolios enjoyed solid outperformance as our value bias, and holdings of positions that should benefit from inflation helped to buffer the portfolios. During the second quarter, these inflation plays retreated as investors speculated that the Fed might accomplish its goals of quashing inflation. For example, commodities including copper fell 22% this quarter and 25% from their 52-week highs. Lumber was splintered by 33% during the quarter and 53% from its highs. Additionally, natural gas prices are 41.1% off of their 52-week highs despite being up 46% year-to-date.

We remain comfortable with the inflation names we own for several reasons. First, we structured the portfolios to be overweight names in the agricultural space. We believe names such as Mosaic, GrainCorp, Bunge, and United Malt should benefit from higher prices without being subject to as many governmental headwinds such as energy and with less economic cyclicality than traditional base metals. Secondly, we have confidence in materials names such as Freeport – McMoRan as we believe the movement toward less fossil fuel consumption will create a favorable backdrop for copper over the long term. Just a few weeks ago, listening to the radio during a recent heatwave, there were bulletins urging consumers to curtail air conditioning during peak hours to help avoid over-stressing the power grid. A few stories later, they were promoting the use of electric vehicles. As value investors, we not only require a stock to have an attractive valuation to be included in our portfolios but are also insistent on having a catalyst to unlock the value that we believe the stock possesses.

While we believe that inflation is likely nearing its peak for this cycle, it will likely remain well above the Fed's stated targets for an extended period. As mentioned above, we are already beginning to see that prices in some areas are declining. Gasoline prices were off a bit from the highs of a few weeks ago, and there are signs that higher mortgage rates are starting to cool the once red-hot real estate market.

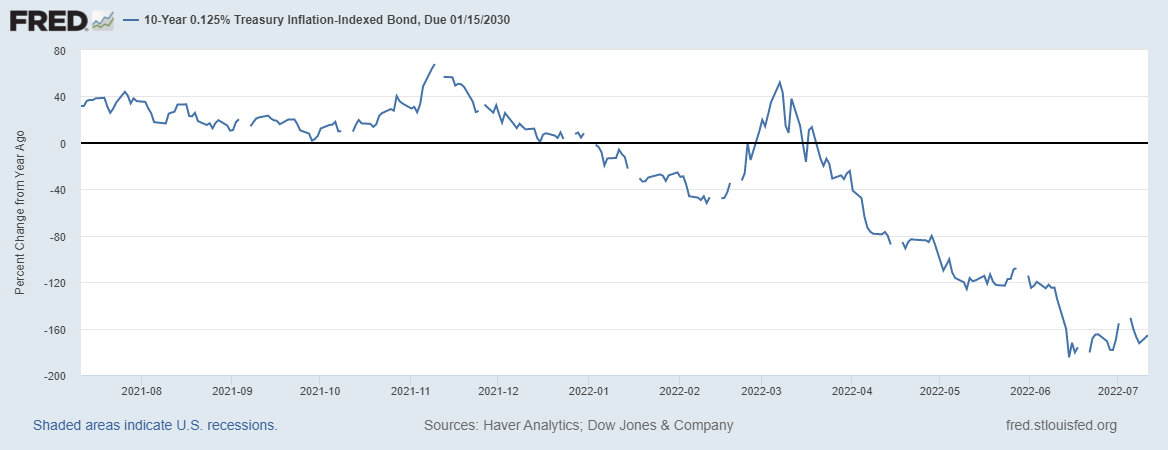

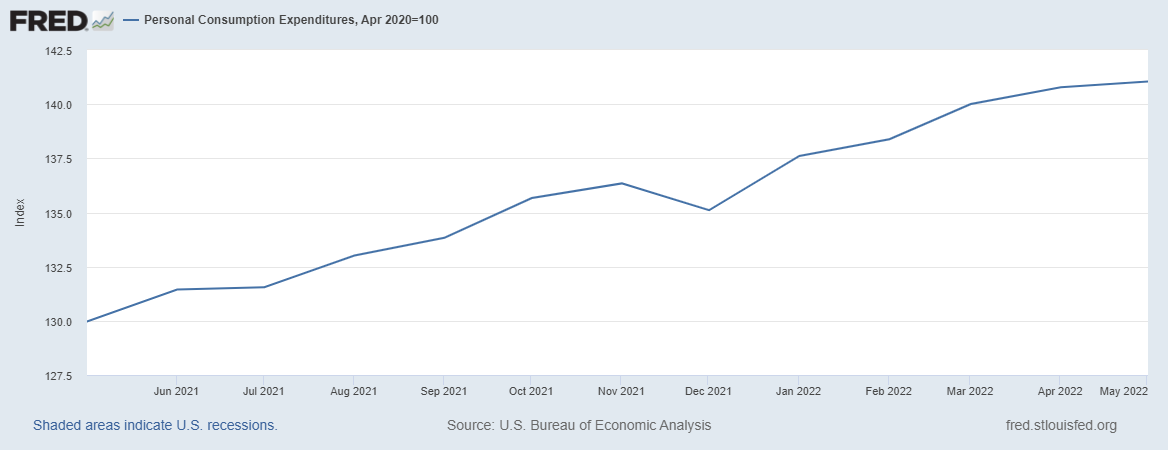

We are starting to see Wall Street’s inflationary expectations impact the bond market as well. Recall that the bond market had one of its worst starts to a new year during the first quarter, as inflationary fears gripped the market. During the second quarter, the yield curve flattened, with short-term rates rising and longer-dated maturities stabilizing. (Note that the Fed tends to have much greater sway over the shorter end of the curve than the longer). Buyers of longer-dated bonds are becoming a bit more optimistic that the Fed will be successful in their efforts to curb inflation. Last year, we purchased Treasury Inflation-Protected Securities (TIPS) in our income-based strategies as a hedge against inflation. Prices of these securities have fallen despite inflation hitting four-decade highs. As illustrated on the following page, the day-to-day pricing of TIPS has more to do with the market’s long-term inflationary forecasts than recent inflation data. Given our previously stated expectation that the economy will likely face multiple years of elevated inflation, we remain comfortable holding TIPS. As it pertains to our other bond holdings, we are keeping our maturities short (under two years) as the flatness of the yield curve does not create a favorable risk/reward environment for long-dated bonds.

Although only history will tell, if/when we enter a recession, we suspect that we are currently in a mild one, although a fair amount of Wall Street economists still believe one can be avoided. Historically, a recession has been defined as a contraction of GDP for two consecutive quarters. We have already had one-quarter of contraction, with GDP declining 1.4% in the first quarter. Currently, the Federal Reserve Bank of Atlanta GDPNow Forecast is estimating Q2 2022 GDP of -1.9%. It should be noted, however, that the Federal Reserve Bank of St. Louis Real GDP Nowcast is estimating Q2 2022 GDP of 3.89%. While there is quite the difference between these two forecasting services, it speaks to the difficulty in predicting the economy in a post-COVID environment. Additionally, while the job market remains strong, with the jobless rate remaining a historically low 3.6% in June, coupled with better-than-expected hiring, there are signs – particularly from big technology companies – that the rate of hiring is due to slow down.

The employment situation is an essential barometer in that the unemployment rate has increased every time there was a U.S. recession. This increase was as little as 1.9 percentage points in 1960 and 1961 and as much as 11.2 percentage points in 2020. The median increase in the jobless rate among all twelve post-World War II recessions was 3.5 percentage points. In fact, the U.S. did not escape any of those recessions with a jobless rate below 6.1%. However, the unusually high number of unfilled jobs in the U.S makes this barometer challenging to predict. The U.S. has recorded more than eleven million unfilled job openings in six of the past seven months, four million more monthly openings than was typical before COVID-19 hit the economy in early 2020. At the same time, labor is scarce, making firms reluctant to fire their workers. The Bureau of Labor Statistics June nonfarm payroll data is evidence that this trend is continuing. Should this persist, we believe the Fed will find it much more difficult to fight inflation and deliver on their dual mandate.

Assuming we are presently in a recession or soon to enter one, we suspect it will last longer than average in terms of duration. According to the National Bureau of Research Economics (NBER), the average recession since World War II (WWII) has lasted just over eleven months. The most prolonged post-WWII recession occurred during the Great Financial Crisis of 2007, lasting 18 months. If you go back to 1857, the average rises to 17.5 months as the recession of 1873 (65 months) and the Great Depression (43 months) tilt the average higher. With those figures in mind, we believe the current economic downturn may take longer than the recent average due to the excessive government tools used to stimulate the economy, negating their recent efforts to quash it. In short, the Fed does not have the tools it currently needs to boost the economy out of a recession. With the Fed's balance sheet near all-time high levels and the Fed Funds rate below 2%, there are no meaningful levers for the Fed to pull. Recall that it was the combination of perpetual Quantitative Easing (QE) that took the Fed's balance sheet to over $9 trillion and three aggressive fiscal stimulus programs that created the inflation firestorm that the Fed is trying to extinguish. An about-face on either front to help an ailing economy will stir inflation fears that much more.

It is hard to believe, but midterm elections are less than four months away. Given the economic uncertainties coupled with policy missteps, we believe this year's midterms may carry more investment sway than most other elections. We will publish a more detailed thought piece regarding the November elections later this quarter. Stay tuned!

We wish everyone a safe and peaceful summer. Going through bear markets and recessions are never enjoyable experiences but, regrettably, are a natural part of investing. The best advice to adhere to is never to act emotionally but rather to stay the course. We take comfort in owning quality companies with attractive valuations which generate solid dividend income. While no one can predict near-term market directions, over the long-haul, equities have historically proven themselves to be long-term builders of wealth and, as value investors, value stocks have a demonstrated history of performing well during periods of inflation.

Managed Asset Portfolios Investment Team

Michael Dzialo, Karen Culver, Peter Swan, John Dalton, and Zachary Fellows

Certain statements made by us may be forward-looking statements and projections which describe our strategies, goals, outlook, expectations, or projections. These statements are only predictions and involve known and unknown risks, uncertainties, and other factors that may cause actual results to differ materially from those expressed or implied by such forward-looking statements. The information contained herein represents our views as of the aforementioned date and does not represent are commendation by us to buy or sell this security or any other financial instrument associated with it. Managed Asset Portfolios, our clients and our employees may buy, sell or hold any or all of the securities mentioned. We are not obligated to provide an update if any of the figures or views presented change.

July 2022