FedEx: Canary In the Coal Mine?

Sep 16, 2022After Thursday's close, FedEx (FDX) announced a sizeable earnings shortfall and withdrew its annual forecast. Its earnings per share for the quarter ending August 31 were $3.44, well below Wall Street consensus. The company's CEO said, "Global volumes declined as macroeconomic trends significantly worsened later in the quarter, both internationally and in the US." Furthermore, he noted that "the company expects business conditions to worsen in the current quarter." Additionally, in an interview with Jim Cramer on CNBC, he said “he believes a recession is impending for the global economy.”

Although we do not own FDX shares in any of our strategies, we believe it is a stock worth watching; as one of the world's largest package delivery companies, FDX is an excellent barometer of economic activity. The fact that business conditions worsened so quickly during the quarter should be an eye-opening event for Jerome Powell and the Federal Reserve (the Fed).

As we have opined numerous times, we believe it will be tough for the Fed to achieve its two primary mandates: stable prices and full employment. We do not envy the Fed, as we believe they are currently between a rock and a hard place. We think they will be forced to choose between the two at some juncture. We would not be surprised to see the Fed end its crusade of raising interest rates well before achieving its 2% target. Perhaps they will justify elevated inflation rates as a cost of narrowing the income inequality gap (think California fast food workers potentially receiving $22 an hour). The Fed is supposed to be politically neutral, but that's easier said than done.

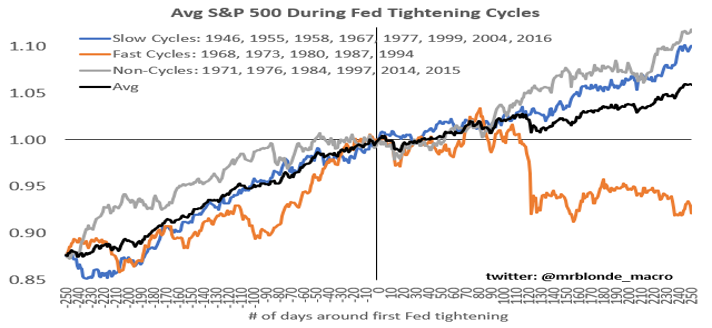

August's Consumer Price Index (CPI) came in higher than expected, ratcheting up investor fears that the Fed will need to become more aggressive with interest rates, possibly for a more extended period. The chart below shows that stocks can usually handle slow/moderate Fed tightening but struggle when the Fed becomes aggressive. This explains why stocks get hit hard on days where inflation numbers are hot, and why stocks tend to rally when some Fed members downplay the likelihood of greater than expected rate hikes. Combine the info from the graphic below with the news from FDX, and the Fed's dilemma becomes crystal clear. The Fed continues to talk a challenging game regarding tamping down inflation, but the question is, do they have the wherewithal to stomach a severe recession? We don’t believe they do.

Food and housing are currently the two hot spots on the inflation front. It is tough to see how further interest rate hikes will tamp out inflation for food. Housing prices are already starting to moderate. Gone are the days when buyers were offing $30,000 or more above the asking price to get their "dream home." When the Labor Department calculates CPI, they use rental rates for their surveys. There remains a shortage of rental properties, as many Americans can not come up with down payments and the ever-rising costs of monthly payments. This has created a shortage of rental properties, which has forced rents higher (the laws of supply and demand really do work). We wonder if rising rates will curtail builders and developers from creating more rental properties, as most are financed and hence are more costly in an environment of increasing borrowing costs.

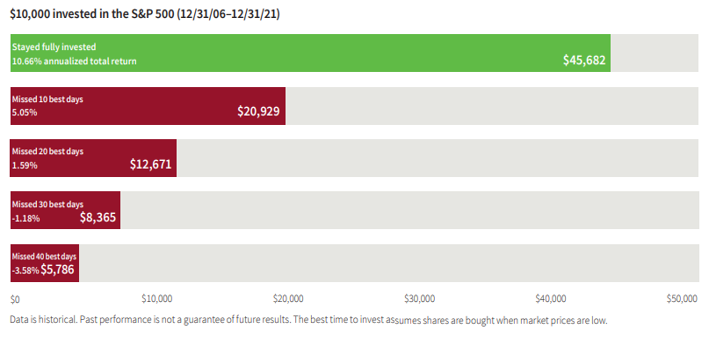

Source: Putnam Investments

Over the near term, the Fed will likely continue to march rates higher to curb the current high levels of inflation. However, we believe that the Fed may slow or end this process sooner than some expect as the economy shows signs of weakening. Considering that the market is always forward-looking, we believe a market bottom may come sooner than some bears forecast. We view market timing as a fool's game and, has been our long-term policy, we will not attempt to time the market. In support of our thesis, the chart above shows what happens when investors miss the stock market's best 10, 20, 30, and 40 days since 2007. We would note that typically some of the sharpest stock market rallies come during a bear market, further validating the dangers of market timing.

We do not see meaningful real economic growth in the near-to-intermediate horizon, and inflation, although coming off its recent 40-year highs, remains stubbornly above the Fed's 2% target. As we briefly referenced above, we do not think it is out of the question that the Fed allows real growth to hover around 0%-1%, with inflation around 3-4% if higher wages are driving that inflation. However, that is a delicate balance and one that could quickly spread to other segments of the economy, causing inflation to spike again. Let's not forget that the last battle against inflation lasted almost ten years and had two distinctive periods where inflation exceeded 10%. In the end, inflation did not truly end until then Fed Chair Volcker raised the Fed Funds rate above the rate of CPI.

The wide range of possible outcomes in the future will likely keep market volatility higher as investors try to find a new trend from each new data release. Given that outlook, we believe our value strategy and overweighting to defensive and value names will enable us to weather through the near-term volatility and position us to recover once the Fed indicates that they will ease up on the interest rate increases.

Please do not hesitate to contact your MAP representative with any questions or concerns regarding the markets. We truly appreciate our relationship as we work diligently every day in an effort to deliver superior risk-adjusted returns.

Managed Asset Portfolios Investment Team

Michael Dzialo, Karen Culver, Peter Swan, John Dalton, and Zachary Fellows

September 2022

Certain statements made by us may be forward-looking statements and projections which describe our strategies, goals, outlook, expectations, or projections. These statements are only predictions and involve known and unknown risks, uncertainties, and other factors that may cause actual results to differ materially from those expressed or implied by such forward-looking statements. The information contained herein represents our views as of the aforementioned date and does not represent a recommendation by us to buy or sell this security or any other financial instrument associated with it. Managed Asset Portfolios, our clients and our employees may buy, sell, or hold any or all of the securities mentioned. We are not obligated to provide an update if any of the figures or views presented change. Past Performance is no guarantee of future results.