All Eyes On The 2022 Mid-Terms

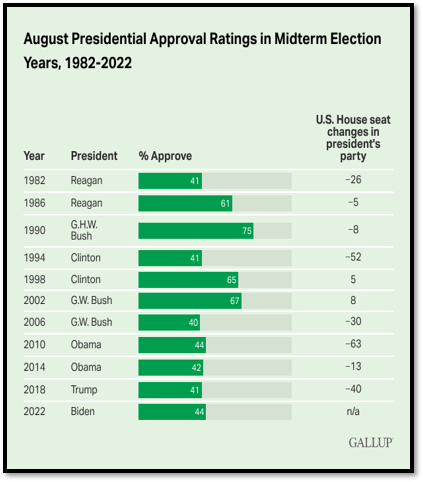

Sep 01, 2022Uncertainty surrounding the economy and current geopolitical conflicts coupled with a period of extreme partisanship in American politics has shaped the upcoming election into arguably the most important midterms in our nation’s history. Heading into these crucial elections, the Democrats currently hold a razor-thin margin in the house (220-211), and an even smaller edge in the Senate (48-50-2), where their only advantage is Vice President Kamala Harris’s tie breaking vote. Looking through a historical lens shrinks the significance of that margin, as the President’s party tends to lose seats in the midterms. To further that idea, only two of the past ten midterms have seen the president’s party gain seats. President Clinton’s 65% August approval rating contributed to the Democrats winning five house seats in 1998. And the 2002 midterms represent the only instance over the past 19 midterms where the president’s party gained seats in Congress while already holding a majority (an event that may not have transpired if not for President Bush’s 67% August approval rating). And while President Biden’s August approval ratings are far from a 60% majority, they represent significant improvement from months past, and the recent upswing could provide hope to Democratic candidates come November.

While we’re discussing reasons for optimism among Democrats, on paper, the passage of the “Inflation Reduction Act” is expected to significantly increase voter confidence, and Biden’s approval ratings have benefited, edging back up from the 38% lows of July. While there has been some improvement in President Biden’s ratings, it is important to note that a recent poll conducted by The Economist/YouGov1 revealed that only 13 percent of Americans surveyed said they believe the Inflation Reduction Act will decrease inflation, and 26 percent said they are not sure. A total of 38 percent of respondents said they believe it will increase inflation, while 22 percent said they think it will have no impact. Among Democrats, 23 percent said they believe it will decrease inflation, with 8 percent of Republicans in agreement. Not surprisingly, most Republicans, 68 percent, said the bill will increase inflation, along with 40 percent of independents and 17 percent of Democrats. While the path forward for Democrats may be starting to clear, the Republicans appear to be struggling to get their act together at the most inopportune time.

To that end, the most significant obstacle Republicans face in 2022 is the recent Supreme Court decision overturning Roe v. Wade. The ruling has been a contentious one with 57% of Americans disapproving. We believe this could invigorate both liberal and independent parties come November. Kansas recently saw nearly 300,000 voters turn out for their 2022 primaries (which included a referendum on abortion) compared to just short of 89,500 votes cast in 2018. The historically Republican state, which incidentally Donald Trump won by 15% in 2020, voted to protect abortion rights with a near 60% majority. However, Roe v. Wade isn’t the Republican’s only problem, as the party is also suffering from an identity crisis. Donald Trump’s loss in 2020 and the ensuing chaos has left the party without strong leadership or a clear agenda. The triad of January 6th hearings, the legal legitimacy of President Trump’s business practices, and the recent FBI raid at his Mar-a-Lago property all represent wildcards for the upcoming election. With the results still unclear, there is a chance that the former president walks away unscathed, an outcome that could energize Republican voters. On the other hand, condemning findings would further polarize an already divided party, and could add fuel to the growing blue flame.

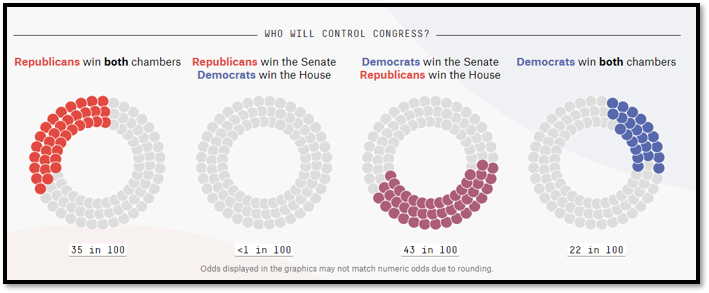

So, with all of that information in mind, who’s going to win? Although low in July, Biden’s approval ratings trended upwards in August as we mentioned above. Given the Republican’s existential troubles coupled with lower headline July CPI numbers, as well as the perfectly timed passage of the Inflation Reduction Act, it is possible there could be a flipping of the script so-to-speak. And while the Democrat’s odds have been improving, (as depicted below) ABC’s FiveThirtyEight still predicts a favorable outcome for Republicans. (The Democrats are favored to retain control over the senate, largely because 20 of the 34 seats up for election are held by Republicans.)

Who Will Control Congress? (https://projects.fivethirtyeight.com/2022-election-forecast/)

Now let’s discuss the potential ramifications of the results. A Democratic sweep would be viewed as a mandate to push a progressive agenda. This would all but ensure an expansion of the federal government, including additional social benefits or stimulus, increased support for green-energy initiatives and infrastructure, as well as possible changes to America’s healthcare and education systems. However, the funding will have to come from somewhere, so tax increases on higher and middle tax brackets would be a foregone conclusion. The Inflation Reduction Act provides a glimpse into what a Democratic victory would look like; a 15% corporate alternative minimum tax, a 1% tax on share buybacks, and $80 billion in funding for the IRS to crack down on under-reporting, a move expected to bring in $200 billion in tax revenue. The bill also allows the government to negotiate drug prices directly with pharmaceutical companies. A Democratic victory could further increase support for federal student loan forgiveness in addition to President Biden’s recent plan that will provide an estimated $300 billion of education debt relief.

On the other hand, should the Republicans take one chamber, we can expect to see political deadlock, and any bills that are passed would require bipartisanship, which is quite unlikely given the current partisan environment. In the event of a red sweep, Republicans would be able to accomplish more of their mandates but would likely need to compromise in a few areas to get legislation signed by the oval office (highly unlikely in most areas in our opinion). A Republican victory could see bills for increased military spending, tariffs on Chinese goods, and support for energy independence and domestic manufacturing to name a few.

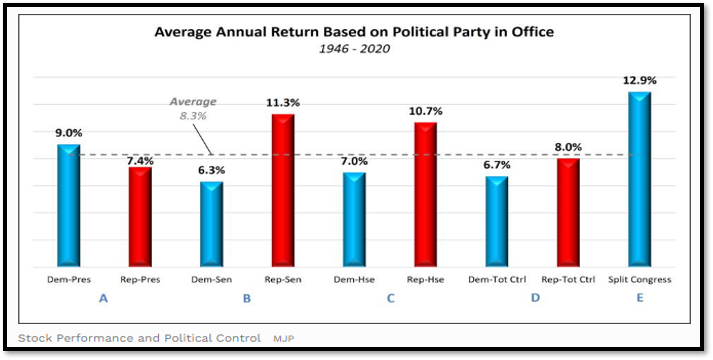

Average Annual Return Based on Political Party in Office (https://www.forbes.com/sites/mikepatton/2021/01/12/stock-performance-and-the-political-party-in-power-an-historical-look-at-the-past-75-years/?sh=6f57bf217a64)

As it pertains to reactions in the broader markets (as illustrated in the chart above), the party in control has mixed effects on markets, but a divided Washington historically tends to yield the best returns. Regardless of the election’s outcome, tax decreases are improbable, and it is difficult to envision an environment that would lead to lower taxes at any point in the foreseeable future, due to the ever-increasing government debt levels. Democratic gains would likely lead to higher capital gains taxes and perhaps a review of the current step up in cost basis. Keep in mind that in 1994 the U.S. Supreme Court unanimously upheld a retroactive increase in the estate tax rate in the case of the United States v. Carlton. Investors sitting on large capital gains may wish to realize those gains while rates are still “low.”

One of the advantages of being a global investor is that we have the ability to invest in countries that offer the most attractive risk versus reward characteristics. While we do not envision making any major reallocations to the portfolios, we will be watching closely to see if adjustments are necessary. Regardless of the election outcome, we believe that meaningful economic growth will be difficult to achieve, and inflation, while trending lower, will likely remain at elevated levels for the next few years. We believe our portfolios are well positioned under this backdrop.

Managed Asset Portfolios Investment Team

Michael Dzialo, Karen Culver, Peter Swan, John Dalton, and Zachary Fellows

September 2022

1https://docs.cdn.yougov.com/jf179lebaq/econTabReport%20%282%29.pdf

Certain statements may be forward-looking statements and projections which describe our strategies, goals, outlook, expectations, or projections. These statements are only predictions and involve known and unknown risks, uncertainties, and other factors that may cause actual results to differ materially from those expressed or implied by such forward-looking statements. The information contained herein does not represent a recommendation by us to buy or sell any security or securities. Managed Asset Portfolios, our clients and our employees may buy, sell or hold any or all of the securities mentioned. We are not obligated to provide an update if any of the figures or views presented change. Past performance is no guarantee of future results.